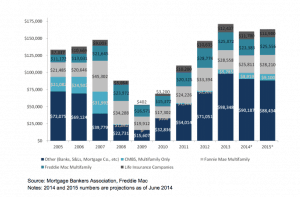

We have called out Fannie Mae and Freddie Mac as big players in the multifamily lending market. They still only represent about 1/3rd of the apartment mortgage industry. And yes, insurance companies love to invest in apartments. The stability of the asset class has broad appeal.

We have called out Fannie Mae and Freddie Mac as big players in the multifamily lending market. They still only represent about 1/3rd of the apartment mortgage industry. And yes, insurance companies love to invest in apartments. The stability of the asset class has broad appeal.

Commercial realtors continue to rank the multifamily sector highest in the commercial real estate space. Given the current fundamentals driving multifamily’s growth, this is not a surprise.

We are not in the habit of announcing acquisitions by other investment companies. But this recent purchase is in the same corridor as two of our Houston properties. We agree with their bullish outlook for the submarket.

This week’s observation from the Harvard JCHS Annual Report on student debt and millennials. There is more outstanding student debt than auto debt or credit card debt. Millennials are carrying the majority of student debt. This affects their credit rating and ability to save for a home. It will keep them renting longer than previous generations:

“Many would-be homebuyers may be burdened by student loan debt. Between 2001 and 2010 the share of households aged 25-34 with student loan debt soared from 26% to 39% with the median amount rising from $10,000 to $15,000.”

Learn how commercial apartment investing works.

Learn from professional investors with over $415,000,000 in commercial multifamily transactions and a 100% profitable track record. Download your Essential Guide now.