The latest news and notes for active commercial multifamily investors:

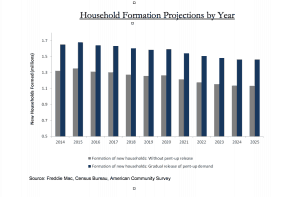

Freddie Mac’s mid-year multifamily report was recently released. There are some fascinating data points, specifically around the re-entry of Millennials into the renter pool. We took a deeper look at the report yesterday and what it means for the multifamily sector going forward.

Freddie Mac’s mid-year multifamily report was recently released. There are some fascinating data points, specifically around the re-entry of Millennials into the renter pool. We took a deeper look at the report yesterday and what it means for the multifamily sector going forward.

One thing I didn’t mention in the deep dive was Freddie Mac’s less than positive outlook on several specific markets. The excerpt is a little long, but for any of our Multifamily Partners that have taken the Market Analysis class, it’s not at all surprising:

“In Washington, D.C. and Norfolk, for example, new supply exceeds historical levels, while demand will struggle to keep pace and may fall short of the supply. The federal sector in both markets composes a large share of the total labor market. While the federal sector was the driver of these markets during the recession, recent drag from fiscal policies has slowed employment growth in these markets. The forecasted vacancy rate is above the historical average, while rent growth is below historical rent growth. This indicates that in the short-run there is a risk that increased supply may lead to weaker multifamily performance.

In other markets, such as Fort Lauderdale, Jacksonville and Las Vegas, while the supply of new units is well below historical levels, both vacancy and rent growth are expected to fare near or worse than historical averages because of lasting impacts from previous housing market shocks in these areas. These markets are still recovering and we do not expect meaningful growth in the near term.”

Could rising rents eventually force people into homeownership? It’s a good question. For some renters who have strong credit and enough money saved to afford a down payment, this could be a real option. The overall risk is still low. Many renters are doing so for lifestyle reasons, and are wary of the long-term commitment of homeownership.

Most participants in our Multifamily Partner Program will tell you that a hidden benefit of the program is the access they get to meet and associate with like-minded individuals. It’s true – the MPP community is full of optimistic, energetic entrepreneurs. And they all suffer from this horrible disease.

Learn how commercial apartment investing works.

Learn from professional investors with over $415,000,000 in commercial multifamily transactions and a 100% profitable track record. Download your Essential Guide now.