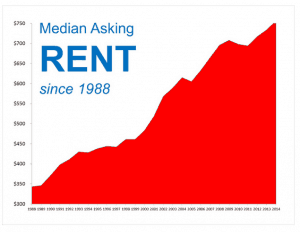

$441 Billion dollars were spent on rent in 2014. This represents an annual increase of slightly less than 5%. Looking at the chart above, two things are clear: We have seen these types of rent increases before. And the “down” markets are very mild and short-lived. There is a reason why multifamily is considered the best risk adjusted investment in commercial real estate.

$441 Billion dollars were spent on rent in 2014. This represents an annual increase of slightly less than 5%. Looking at the chart above, two things are clear: We have seen these types of rent increases before. And the “down” markets are very mild and short-lived. There is a reason why multifamily is considered the best risk adjusted investment in commercial real estate.

It’s not just rents that are going up. Sales prices for multifamily projects also went up last year. The numbers are not surprising to industry observers. Sales prices are driven by income. Income is driven by rent. And as we know, rents are going up. One of the big surprises for many of our Multifamily Partners is the straightforward nature of valuation. It’s simple. If your apartment project is making money, you will get a fair price.

We are active in the Austin market and watch it closely. The surprise here is not the amount of the rent increases. They are in line with national averages. What is truly impressive is that rents are predicted to go up while a record amount of new inventory is hitting the market. It bears watching.

It’s reassuring that others are seeing the same trends we see. The fundamentals of this asset class are undeniable. The two largest generations in U.S. history are choosing apartment living over homeownership.

Learn how commercial apartment investing works.

Learn from professional investors with over $415,000,000 in commercial multifamily transactions and a 100% profitable track record. Download your Essential Guide now.